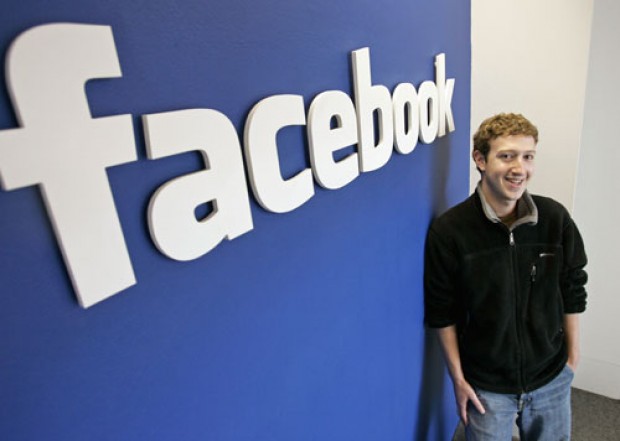

Facebook Inc (NASDAQ:FB) was forced to take down its new Midnight Deliveries service, which was aimed at sending messages to friends on the stroke of midnight on New Year’s Eve, after a major security flaw was found.[article_detail_ad_1]

Don’t worry it is fixed now. IBTimes UK reports it has tested Facebook Stories at 11pm GMT and revealed the service is working once more, and no matter what user ID they typed into the address bar, they were returned to the New Year messages they had sent from their own account.

The flaw is reportedly quite safe to the majority of users, but if anyone has to say something more personal or include photos that they would not want to be made public, then the problem clearly exists there.

Facebook (FB) is struggling to become the number-one place for online users with privacy being the priority, but if it fails to be trusted to deliver just a simple New Year’s Eve message without showing it to all one billion users, then trust in the network by a number of users will undoubtedly decline.

Where the Facebook (FB) stock stands now?

The stock closed at $25.91, down 0.14 points or -0.53% from previous close and at a distance of 4.99% from 20-day simple moving average. In the last trading session, the stock’s price moved 5.11% above its 200 day moving average, changing hands as low as $25.15 per share. The stock is currently trading 8.39% up its SMA 50.

The share price performance over the last 12 months

The price range in the past fifty two weeks had a highest hit of $45.00 on May 05, 2012 while lowest level during that period was $17.55 on Sep 04, 2012. The 1-year target price estimate, which is the median price target, as set by analysts covering the stock is $32.00. The stock has dropped -32.22% since the beginning of this year.

How the market shifts persuade this stock?

To measure price-variation, we found this stock’s volatility over a week period was 3.63% and for the month was 3.84%.

Need expert advice?

The analyst mean recommendation for this week has been 1.9, same as was in the last week. The price target of $15.00 was the lowest while the highest price target was set as $38.00, according to 25 analysts surveyed by Thomson Reuters.

Leave a Reply