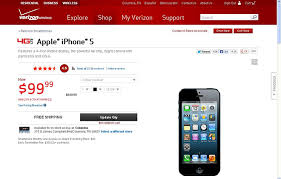

Apple Inc. (NASDAQ:AAPL) has long lasting relationship with different phone carriers, and major sales of iphone is held through Verizon Communications Inc. (NYSE:VZ). The leading smartphone firm has made immense paces for several years in getting carriers to subsidize their devices. Previously, an iPhone worth of $600 at Verizon has costs the consumer only $99.99 if they sign up for a 2-year contract.

The subvention has been an aggressive weapon for each carrier while they contended for a share of new users. At the similar time, the carriers have utilized the financial backing as a means of locking in the user to a 2-year agreement in an effort to retain subscribers and prevent competitors from poaching.

Therefore, in this phase it is analyze that with the maturing and in the end the saturation of the market, revenue comes from new subscriptions has dropped and that results come zero.

The carriers firm to watching their own economic conditions, they have had to create solid deals that propose a low monthly fee other than involve a much larger one if the subscriber goes in excess of limits on data, texts, voice, or whatever, or builds use of their phone in several hours. Data usage has turn out to be the means driver, with exponential growth in data service fees getting centre stage in carrier economics and impending $90B for the industry in 2013.

Apple Inc. (NASDAQ:AAPL) desires to sell iPhones in bulk quantity and for this price is so important. As well, price has core issue for the carrier, because carrier support is an important means to sales. The subsidy from carrier makes it probably to reach consumers who might balk at the $599.99 price. The carrier having granted the subsidy requires making out by having users encouraged to make use of many data, ideally more data than their base plan covers.

Leave a Reply