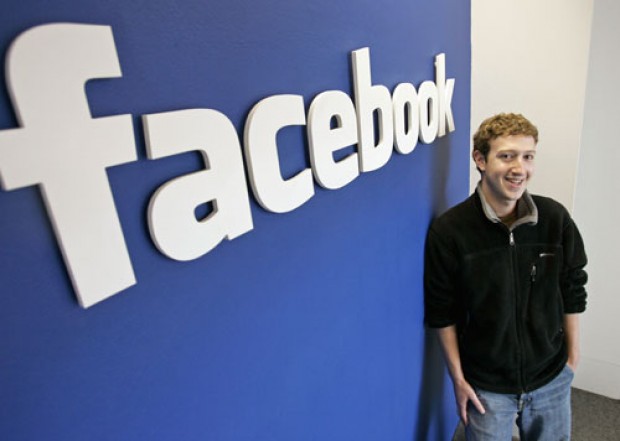

Facebook Inc. (NASDAQ:FB) dropped the most in nearly three months after a lockup expiration increased the number of tradable shares and a fresh run-up in the stock price gave investors pause regarding how much higher it might surge.

The stock dropped 5.1% to $26.81 at the end of trade in New York, the largest drop since September 24. Shares in the operator of the world’s biggest social-networking service have slipped 29% since selling at $38 each in an initial public offering in May.

Facebook came under pressure as almost 156 million more shares became available for trading recently, adding to the over 1.5 billion previously freed up for sale by insiders. Stockholders may have seen a good time to sell since the stock has increased rapidly amid increasing optimism regarding the company’s development prospects, commented Scott Kessler, an analyst at S&P Capital IQ.[article_detail_ad_1]

Kessler stated that a lot of the worthy news appears to be priced into the shares, what he think people are thinking about is, what else can occur?’ whether it’s driven by definitely by Facebook, or others, to drive the stock up.

Microsoft Corporation(NASDAQ:MSFT) was a sizzling topic after some analyst actions.BMO Capital Markets started coverage of Microsoft at market perform and a price estimate of $30.

Karl Keirstead, an analyst at BMO, stated that end result, they conclude that a pathetic PC market, a slowdown in transactional enterprise license sales, and a slow incline of Surface tablet sales will cap the positive in Microsoft shares.

He added that although we are positive on touch-enabled PCs and enterprise demand for Office-assisted Windows tablets, demand could take longer-than-projected to ramp.

Leave a Reply